Which Grocery Stores Offer the Best Prices and Quality?

Last updated November 2025

Our latest comparison of Chicago area supermarkets’ prices and quality is in the bag. Consumers’ Checkbook researchers shopped stores using a 150-item list to compare prices. To evaluate stores on quality of products and service, we surveyed our members. Click here for more info on our surveys and research methods. The figures below summarize our findings; for details, see our Ratings Tables. Here’s what we found:

ALDI offers big savings.

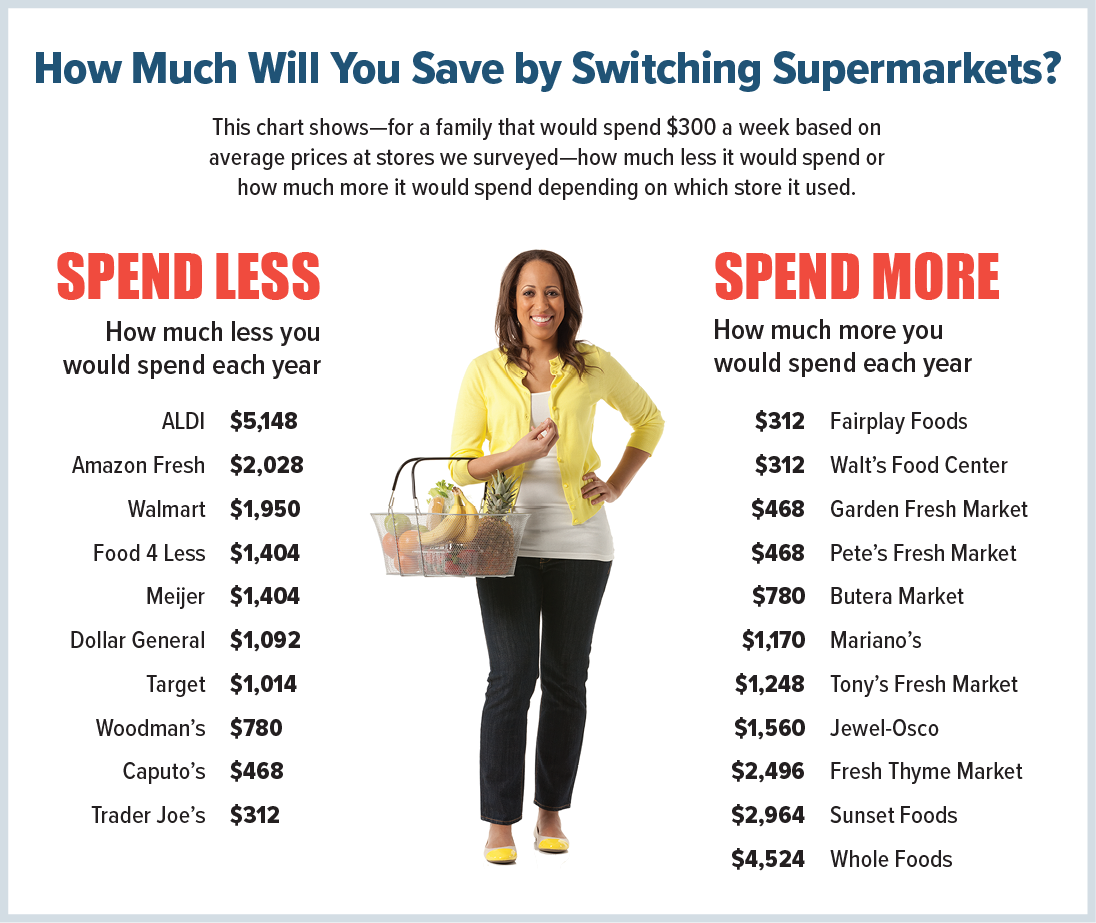

The German-based discounter, ubiquitous in most of western Europe, focuses on low costs, and our survey found ALDI quite inexpensive: For our shopping list, its prices were 33 percent lower than the all-store average. ALDI’s per-unit prices were even lower than Costco and Sam’s Club.

These savings are partly explained by ALDI’s smaller-format stores, which have much lower overhead costs than conventional supermarkets.

ALDI also benefits from different expectations. Shoppers at Jewel-Osco, Meijer, Walmart, etc., expect to always find their favorite brands on the shelves. Like Trader Joe’s, ALDI carries mostly its own brands, not national-brand products. ALDI does offer some national brands, but overall, selection is limited. In other words, you’ll find some of the most popular brands (Coke, Heinz ketchup, Hellmann’s mayo, etc.) at ALDI, but probably only in one size.

Instead, ALDI’s shoppers trade that quirkiness for comparable very-low-priced products. (To account for brand differences, we used a modified market basket to compare ALDI and Trader Joe’s prices with conventional supermarkets; click here for more info.)

Other price standouts: Amazon Fresh, Food 4 Less, Meijer, and Walmart.

Amazon Fresh’s prices were about 13 percent lower than the all-store average, Walmart’s were 12 percent lower, and Food 4 Less and Meijer each nine percent lower.

For a family that spends $300 per week at the supermarket, a 13 percent price difference totals savings of $2,028 per year; a nine percent price difference totals $1,404 a year.

Amazon Fresh opened its first Chicago area location in 2022; the region now has 10 and counting. These small-format stores focus on low costs and convenience (the company’s app keeps track of what you remove from shelves; when finished you simply exit without scanning items).

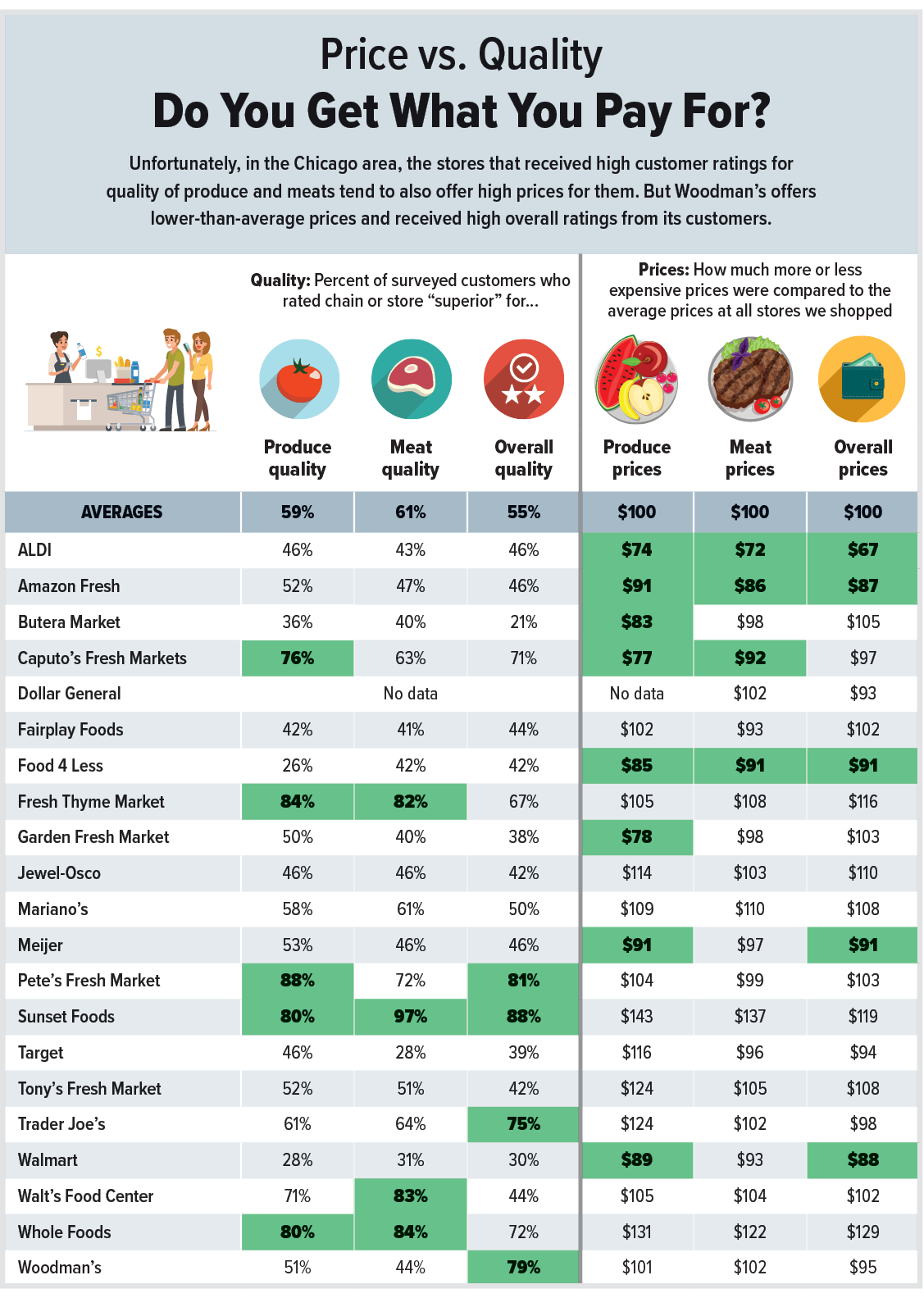

Woodman’s Markets continues to wow with high ratings for quality without a price penalty.

The local chain didn’t receive rave reviews for the quality of its produce or meat, but did get very high ratings on our survey question on “overall quality”—79 percent rated it “superior” overall. And Woodman’s prices were about five percent lower than the all-store average.

Mariano’s slides significantly on all measures.

Once a local supermarket favorite, in our most recent surveys of shoppers Mariano’s received middling scores for quality, with only half of its customers judging it “superior” overall—similar to the middling-but-not-bad scores earned by Meijer.

Mariano’s also is no longer among the lowest-priced chains operating in the Chicago area. In 2022, its prices were about five percent lower than the all-store average; this time, they were eight percent higher than average, or about 18 percent higher than Meijer and 23 percent higher than Walmart.

Trader Joe’s remains popular.

Seventy-five percent of survey respondents rated the funky-and-fun chain “superior” for “overall quality.” Although not among the least expensive grocery options in the area, TJ’s prices were 13 percent lower than Jewel, and nine percent lower than Mariano’s.

Jewel’s prices were higher than most other traditional supermarkets’.

The chain with the most grocery stores in the area charges higher prices than most of its competitors. Jewel’s prices were about 26 percent higher than Walmart, 21 percent higher than Meijer and Food 4 Less, and 18 percent higher than Target.

Pete’s Fresh Market offers a solid price-quality combo.

Pete’s has 20 Chicago area stores and its surveyed customers raved about its produce and overall quality; its prices were a bit higher than the all-store average, but about six percent lower than Jewel’s.

Fresh Thyme also continues to impress for produce but its ranking for price has risen.

In our last price survey, Fresh Thyme, a Downers Grove-based chain that describes itself as “offering fresh and healthy food at amazing values,” had prices that were slightly better than average. But in our latest round of shopping, its prices were about 16 percent higher than the all-store average. It charged especially high prices for the brand-name nonperishable items on our shopping list.

Fresh Thyme does continue to receive generally favorable ratings for quality, with 67 percent of its surveyed customers rating it “superior” overall and more than 80 percent finding its fresh produce and meats “superior.”

Whole Foods remains an expensive choice.

When Amazon purchased Whole Foods in 2017, many experts predicted the combination would punish its supermarket competition by combining Whole Foods’ solid reputation with Amazon’s pursuit of distribution perfection. Many consumers hoped they’d pay Amazon-like prices for Whole Foods-quality products. That hasn’t materialized.

Whole Foods built a loyal following by offering high-quality produce, meat, prepared foods, and generic staples. It continues to receive high marks in our surveys of consumers, especially for produce and meat quality. But our price survey found that Whole Foods remains the most expensive choice among stores we shopped: Its overall prices were about 29 percent higher than the average prices at all stores we surveyed, or about 47 percent higher than Walmart, 25 percent higher than top-rated Pete’s, and 48 percent higher than Amazon Fresh, its corporate sibling.

Target and Walmart received dreadful ratings for quality.

Walmart was rated “superior” for “overall quality” by only 30 percent of its surveyed customers, and Target by only 39 percent. Butera Market and Garden Fresh Market also failed to get “superior” overall ratings from even 40 percent of their surveyed customers. Several other chains, including ALDI, Amazon Fresh, Food 4 Less, Jewel, and Meijer didn’t do much better.

Within the largest chains, there is relatively little store-to-store price variation.

Prices at the Jewel, Mariano’s and Target locations we surveyed were roughly the same from store to store.

We also checked out warehouse clubs, looked at unique stores Trader Joe’s and ALDI, and examined grocery delivery options.

Check out the other articles in our “Grocery Stores” category and our ratings tables for info on all the local grocery options, how we rated them, and tips on saving no matter where you shop.