Last updated November 21, 2025

Medicare’s 2026 Open Enrollment period runs from October 15 to December 7, 2025, giving beneficiaries a critical window to review and update their coverage.

During this time, you can:

- Join, drop, or switch a Part D prescription drug plan if you have Original Medicare.

- Switch between Original Medicare and Medicare Advantage (MA).

- Change your Medicare Advantage plan, including to one with or without drug coverage.

Whether you’re considering switching plans or simply want to ensure your current coverage still meets your needs, understanding the following eight essential facts will help you avoid surprises and make informed choices for the year ahead.

Helpful Resources

Each fall, older Americans are inundated with Medicare advertisements, many of which come from salespeople working for insurance brokers. These brokers often earn commissions based on the plans they enroll you in, and they may not present all available options, or prioritize your best interests.

If you’re looking for unbiased, trustworthy guidance, we recommend the following resources:

Medicare & You: This official annual handbook from Medicare provides a comprehensive overview of how Medicare works, including detailed explanations of Parts A, B, C, and D. It’s a great starting point for understanding your coverage options.

Medicare Plan Finder: This online tool from Medicare lets you compare Medigap, Medicare Advantage, and Part D plans available in your area. You can enter your prescription drugs and preferred pharmacy to see how much your prescription drugs will cost. New this year: You can now enter your healthcare providers to see which Medicare Advantage plans they accept. Unfortunately, there are errors; confirm with your healthcare providers that they’re in-network for any plans you consider.

State Health Insurance Assistance Program (SHIP): Offers free Medicare counseling from trained local volunteers who provide one-on-one unbiased support.

Checkbook Health: For nearly 50 years, Consumers’ Checkbook has helped federal annuitants understand how the Federal Employees Health Benefits Program and Medicare work together. In the coming year, Checkbook Health will expand to offer general Medicare enrollment guidance.

Stay up to date by following the Checkbook Health YouTube channel for the latest tips and insights.

Increased Costs in 2026

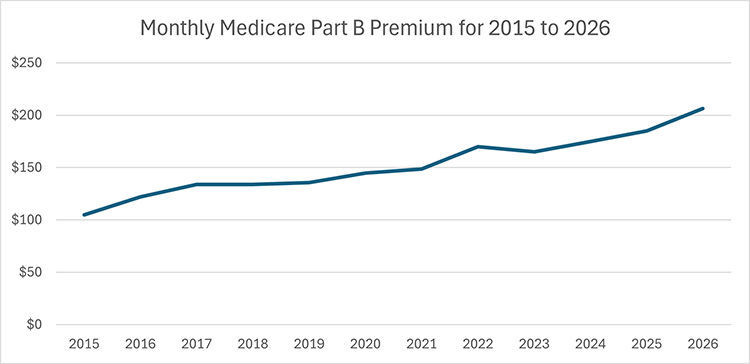

The Part B premium will increase by $17.90 per month, to $202.90—that’s the largest annual hike since 2022.

Other out-of-pocket costs also will rise. The deductible for Part A, which covers inpatient hospital care, will increase by $60, to $1,736. Keep in mind that the Part A deductible is not annual; it’s a benefit-period deductible, so if you have two separate inpatient hospitalizations, you’ll pay that deductible twice.

For Medicare Part B, which covers doctor and outpatient services, the 2026 deductible will increase by $26, to $283.

Part B and Part D IRMAA

If you’re a higher-income Medicare beneficiary, your premiums for Part B and Part D may include an Income-Related Monthly Adjustment Amount (IRMAA), a surcharge based on your Modified Adjusted Gross Income (MAGI) from two years prior. For 2026, that means your 2024 tax return will determine whether you owe IRMAA.

Both the income thresholds and the surcharge amounts will increase for 2026:

- Individual tax filers will face IRMAA if their 2024 MAGI exceeds $109,000 (up from $106,000 in 2025).

- Married couples filing jointly will be subject to IRMAA if their MAGI exceeds $218,000 (up from $212,000 in 2025).

IRMAA is applied in five tiers, with higher incomes resulting in higher monthly surcharges. In the first income tier, the Part B IRMAA surcharge will rise by $7.20, to $81.20 per month. The Part D IRMAA surcharge for the first tier will increase by $0.80, to $14.50 per month.

Higher Part D Out-of-Pocket Limit

The $2,000 out-of-pocket Part D limit, introduced in 2025, was one of the most important Medicare enhancements in recent years. It eliminated the “donut hole” phase of coverage and offered significant financial relief to those with high prescription drug costs.

In 2026, the cap will increase slightly, to $2,100 per person. Once you reach that threshold, you won’t pay anything for covered prescription drugs for the remainder of the calendar year. The out-of-pocket limit applies to both standalone Part D plans and Medicare Advantage plans that include Part D coverage.

While the increase is modest, it’s important to factor this change into your budget and when you compare available plans during Open Enrollment.

Part D Payment Plan

Starting in 2025, to help beneficiaries with high prescription drug costs, Medicare introduced a voluntary program that spread out payments for medications more evenly throughout the year. There is no cost to participate. Here’s how it works:

- No payment at the pharmacy: Instead of paying when you pick up your prescriptions, your Part D plan will bill you directly.

- Monthly billing: Your monthly bill includes charges for the current month’s prescriptions, plus any unpaid balance from the previous month. This total is then divided by the number of months remaining in the calendar year.

- Timely payments required: You must pay your bill on time to remain in the program. If you miss payments, you’ll be removed (but you’ll stay enrolled in your Part D plan).

While this payment program can help you manage expenses throughout the year, it won’t save you money or lower your overall annual drug costs. Use this Medicare.gov resource to see if you would benefit from participating.

Available Medicare Advantage Plans

The number of MA plans available in your area may change next year, as major insurers like UnitedHealthcare and Humana are reducing their service areas.

Your plan for 2025 was required to send you an Annual Notice of Change at the beginning of October. This notice outlines any changes to your coverage, including whether your plan will be discontinued. If you haven’t received it, contact your plan to request a copy.

Access to Providers

With Original Medicare, you can see any provider nationwide who accepts Medicare. However, participation can change throughout the year. Some providers may stop accepting Medicare altogether, or they may choose not to accept Medicare assignment, which means they can charge up to 15 percent more than the Medicare-approved amount. To confirm a provider’s status, use the official Medicare Provider Search tool.

If you’re enrolled in Medicare Advantage, your access to providers is determined by the plan’s network. Providers can drop out at any time; sometimes these changes are significant. For example, in August 2025, UnitedHealthcare and Johns Hopkins ended their contract, making Johns Hopkins providers and hospitals out-of-network for UnitedHealthcare members. Here’s a list of other health systems that are dropping Medicare Advantage plans.

To check whether your providers are in-network:

- Use Medicare Plan Finder, which now includes an integrated provider lookup for Medicare Advantage plans. Caution: This new service might report incorrect provider information. If you select a Medicare Advantage plan based on incorrect provider info, Medicare will give you a three-month window to select a new plan.

- Also visit your plan’s website and use its provider directory to verify that your doctors and preferred hospitals are preferred providers.

- Finally, call your provider and verify that they accept your plan.

Access to Telehealth Services

Medicare beneficiaries who use telehealth services for non-behavioral health medical appointments may have seen a disruption this fall when laws funding these services expired during the government shutdown. When the government reopened in November, telehealth services with enhanced flexibility were extended through January 2026.