Do I Owe Taxes on My Cryptocurrency Investments?

Last updated March 28, 2022

If you bought, sold, or mined digital currency last year, those transactions might be subject to federal taxation.

The IRS considers cryptocurrency to be property that is taxed like other investments, such as stocks.

If you sold, exchanged, or used any virtual currency last year—cashing it in on an exchange, or using it to buy goods or services—and the value of that crypto was higher than when you acquired it, you likely made a taxable capital gain.

“For instance, if you bought $50 worth of Bitcoin and it was worth $100 when you sold it, you’d pay capital gains taxes on the $50 increase, most likely,” Andy Rosen, an investments writer at NerdWallet.com, told Checkbook. “On the other hand, if you owned crypto last year, but you didn’t sell it—even if your portfolio increased in value by a good amount—you won’t owe any taxes for the investment gains. You haven’t realized the gain until you cash it out.”

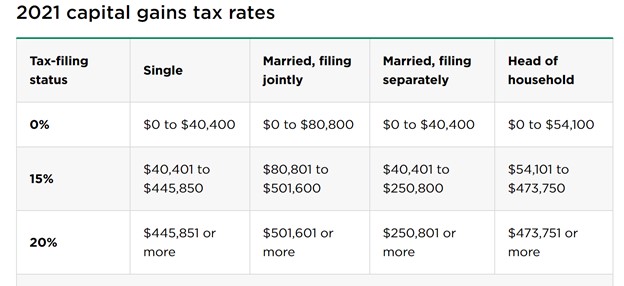

If you owned that digital currency for more than a year before selling it (or using it to purchase something), that should qualify your profit as a long-term capital gain, which is usually taxed at a lower rate than regular income. The chart below from a NerdWallet blog post on crypto taxes shows the capital gains tax rates for this filing season.

NerdWallet also has a 2021 capital gains calculator.

While you can expect to get Form 1099s from financial services, you may not get any paperwork from an online exchange that handled your cryptocurrency transactions. (Crypto brokers will be required to send 1099s in 2023.)

“But that doesn’t mean you don’t owe taxes on your capital gains,” Rosen cautioned. “So, it may be on you to figure out exactly what you owe.”

Some exchanges will send you the info you need to create the document for the IRS, he said. Others will allow your tax software to import the information. There are also dedicated crypto tax software programs which will help you square-up with the IRS.

If you sold cryptocurrency at a loss last year, you may be able to use some of those capital losses to offset capital gains on other sales, similar to losses on stocks or bonds.

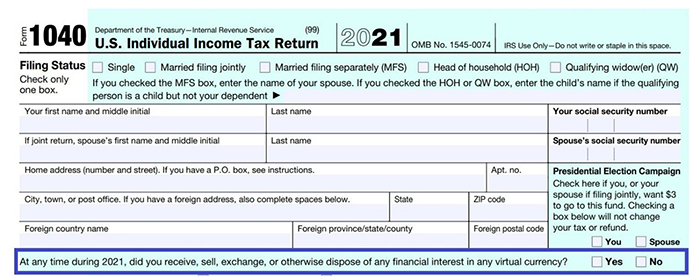

To make it clear that it expects taxpayers to report crypto capital gains, the IRS added this question to the first page of the 1040 tax return: “At any time during 2021, did you receive, sell, exchange or otherwise dispose of any virtual currency?”

Everyone is required to answer this question, not just those who had any transaction involving virtual currency. Answer “yes,” and you may be flagging your return for extra scrutiny.

An IRS news release issued a few weeks ago explains that taxpayers who “merely owned virtual currency” at any time in 2021 can check the "No" box when they have not engaged in any transactions involving virtual currency during the year, or their activities were limited to:

- Holding virtual currency in their own wallet or account.

- Transferring virtual currency between their own wallets or accounts.

- Purchasing virtual currency using real currency, including purchases using real currency electronic platforms such as PayPal and Venmo.

- Engaging in a combination of holding, transferring, or purchasing virtual currency as described above.

That news release also has detailed instructions on when to answer “Yes,” and what forms must be used to figure the capital gain or loss.

More Info: Information on virtual currencies from the IRS

Contributing editor Herb Weisbaum (“The ConsumerMan”) is an Emmy award-winning broadcaster and one of America's top consumer experts. He is also the consumer reporter for NW Newsradio in Seattle. You can also find him on Facebook, Twitter, and at ConsumerMan.com.