Last updated November 2025

It costs thousands of dollars to replace a furnace, air conditioner, roof, or water heater, or to redo a kitchen or bathroom. Many homeowners don’t have that much cash on hand, which creates financial problems—especially if your HVAC equipment dies during a polar vortex or heat wave.

Need help paying for a project? You have several options, including credit cards, home improvement loans from banks, and equity lines of credit. Most contractors also offer financing, usually through third-party lenders; but before signing, make sure you know exactly what you’re agreeing to. Many promote “no-interest” loans that actually carry hefty interest rates, and some companies now offer what we think is the worst deal we’ve seen in our 50-year history: HVAC leasing programs.

The Expensive HVAC Lease That Never Dies

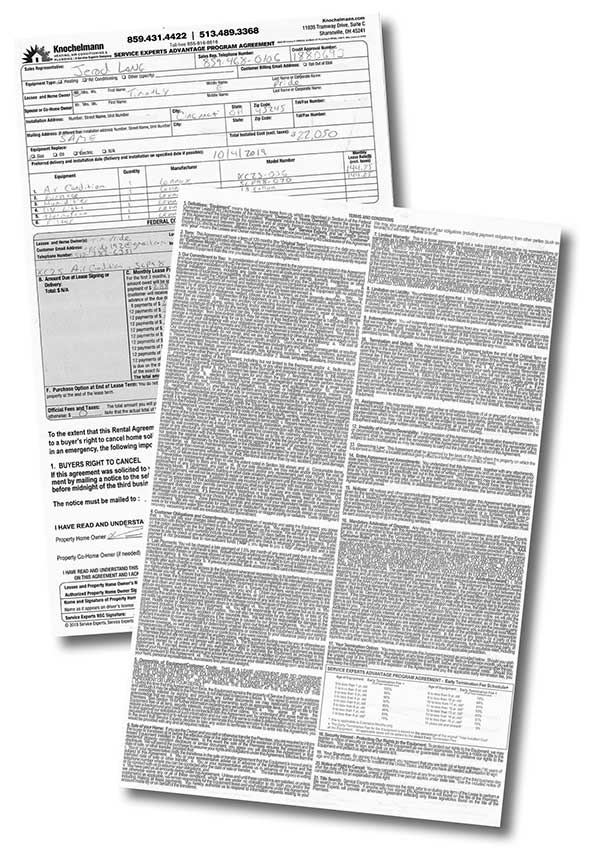

In 2019, Tim Pride, a retired firefighter living in Cincinnati, sought help with a broken central AC unit. He called in Knochelmann Heating, Air Conditioning & Plumbing; their representative told him he should replace both his AC and furnace.

Knochelmann quoted a total price of $22,050 to supply and install a new Lennox central AC, furnace, humidifier, UV light, thermostat, and filter. Pride says he got “a bit of a hard sell”: The salesperson initially quoted a higher price but “he offered to knock off a couple thousand dollars” if Pride signed the sales contract that day.

Surprised by the high cost, Pride asked about payment options. He said Knochelmann’s rep told him the company could provide a way to spread out the payment over many months. When Pride asked about the interest rate, he was handed a contract showing monthly payments of $288.50 over 10 years, with a “Total of Payments” entry of $33,754.50. Pride said he did some quick math, decided the interest rate seemed reasonable, and signed.

What Pride didn’t realize—and what haunts him now—is that he had signed a lease, not a loan. We reviewed his contract and think it’s an astonishingly terrible deal. Here’s what it stipulates:

What Pride didn’t realize—and what haunts him now—is that he had signed a lease, not a loan. We reviewed his contract and think it’s an astonishingly terrible deal. Here’s what it stipulates:

- Monthly payments of $288.50, or $33,755 over the first 10 years of the lease.

- The contractor, not the homeowner, owns the air conditioner, furnace, and other equipment. After 10 years, the contractor continues to own the equipment and Pride must continue making monthly payments of $288.50 to keep it. The only way out is to pay a hefty termination fee (more on that below).

- If Pride stops making his monthly payments, the company can disconnect his air conditioner and furnace until the balance is paid.

- During the 10 years, if Pride terminates the lease or stops paying the monthly fee, the company may remove the equipment; if so, he must pay the termination fee described below, plus an extra $500.

- The lease transfers with a home sale. If Pride sells his house, he must disclose the lease to buyers, who can either accept it or force Pride to pay termination fees.

Here’s the most painful part: After Pride pays that $33,755 over 10 years, he still won’t own anything, and he has only two options to keep using the air conditioner and furnace, both of which are expensive: Continue paying $288.50/month or cough up a termination fee equal to 61 percent of the original cost—or $13,451.

So, the math: Pride’s total cost to actually own the equipment after 10 years: $47,206 ($22,050 for the AC, furnace, and installation, plus $11,705 in finance charges, plus $13,451 termination fee to end the lease). That’s more than double what he would have paid upfront had he paid cash.

Pride can terminate the lease earlier by paying an even steeper fee. If he canceled during the first year, he would have paid 100 percent of project costs ($22,050). After two or three years, the termination fee would have dropped to only 96 percent ($21,168). Even after making monthly payments for 15 years, Pride will still be on the hook for a termination fee of 15 percent ($3,308) to end the lease.

This is not how car leases work. With vehicles, payments are calculated based on depreciation during the lease term. For a $50,000 car that’s worth $30,000 at the end of your lease term, you’d pay for the $20,000 of depreciated value, plus interest. Pride’s leasing deal requires him to pay for the entire cost of his air conditioner and furnace, plus interest, and then to keep right on paying to keep using them.

Pride says the sales rep told him that if he signed on for the “plan,” Knochelmann would “take care of all repairs and come out twice a year to do maintenance,” and websites for HVAC leasing companies tout this as an important feature of their products. But because homeowners won’t actually own the equipment, this isn’t a surprising condition. And the benefit is small: New HVAC equipment usually doesn’t need many repairs during the first 10 years, and the cost to replace most parts is paid under manufacturers’ warranties.

Leases also leave homeowners with limited options, binding them to one contractor for all maintenance and repairs. What if the company doesn’t respond quickly to fix breakdowns? No one else can legally work on the system.

Pride says Knochelmann did act quickly to fix his air conditioner after it broke down about a year after installation. But although the sales rep promised the company would proactively conduct twice-yearly maintenance visits, Pride says he has always had to initiate contact to schedule work.

Hundreds of Unhappy Customers with Similar Stories

The contract Pride signed is lengthy, but it does state in several spots that it is a lease. The full terms and conditions printed on the back of the form run thousands of words and include descriptions of who owns the equipment and a termination-fee schedule.

Pride insists he had no idea he was signing a lease instead of a loan. He says the salesperson never used the word “lease”; that he was only told the agreement provided “a way to spread out payments over 10 years.” He says he definitely wasn’t told that, after 10 years, he still won’t own the HVAC equipment—nor that he must continue paying monthly fees to keep it.

“I’ve never leased a thing in my life,” he said. “I’ve never leased a car. I’ve never heard of such a thing for furnaces and air conditioners.”

Pride didn’t discover his mistake until early 2025, when he and his wife decided to check the payoff amount for what he thought was a loan. “My wife was looking at the paperwork and said, ‘This is a lease.’ I thought, ‘you gotta be kidding me.’”

Unfortunately, Pride’s experience mirrors that of at least hundreds of others. Knochelmann is owned by Service Experts, a Texas corporation operating HVAC and plumbing companies in 30 states. Service Experts in turn is owned by Brookfield Infrastructure Partners, a multinational investment company based in Toronto.

At the time of this writing, the website of the Better Business Bureau (BBB) reported having received more than 600 complaints against Service Experts in the past three years. For many of those complaints, the BBB’s website displays summaries of problems, as written by consumers. Many say that they unknowingly signed HVAC leases thinking they were getting a loan. And they frequently complain they weren’t told they won’t own the equipment after making payments for 10 years. Complainants often say that sales reps told them they were signing a maintenance-and-repair agreement, or “membership,” and that the word “lease” was never used.

Several of the complaints lodged with the BBB allege that Service Experts salespeople sold leases to older homeowners; some accuse Service Experts’ staff of forging signatures on leasing contracts.

Checkbook asked a spokesperson for Service Experts how many HVAC leases it issued in the last five years and how many are currently in effect. We also asked Service Experts to comment on the disturbing number and nature of complaints filed against it. The spokesperson declined to provide answers.

The corporation that owns Service Experts also owns HomeServe, the largest writer of home warranties in the U.S. We’ve written about those bad deals before; visit our “Home Warranties” section for our advice on why you shouldn’t buy them. HomeServe’s website also advertises leases.

Also Watch Out for Deceptive “Zero-Interest” Loans

Many home improvement companies offer traditional financing through third-party lenders, but some often provide misleading information about terms. Contractors frequently advertise things such as “zero-percent interest for two years” when the loan actually carries hefty interest if you don’t pay it off within a promotional period.

A few years ago, I needed to replace a heat pump. The new unit cost $7,886 installed. The contractor offered me a payment plan with a “two-year interest-free period.” I assumed that meant he would pay off the loan with 24 monthly payments of $328.58, with no interest, and agreed.

However, the loan terms had me pay $200.21 monthly ($4,805 total) for two years. If I didn’t pay the remaining balance ($3,081) within those 24 months, the loan would convert to a standard five-year loan with a 17.99 percent APR—meaning total payments of $12,013 for the $7,886 heat pump.

Fortunately, a few weeks after the work was completed, I received paperwork which clearly described the balloon payment required within 24 months to avoid interest, and I paid off the loan by that deadline. In the end, the deal helped me manage cash flow. But my case also provides an important lesson: You must carefully assess financing offers, including reading the fine print.

Most HVAC equipment loans run five to 15 years with interest rates of 12 to 18 percent. Interest rates typically are lower than credit card rates because home loans are considered “secured” debt: If you stop paying, then the lender will slap a lien on your home.

Other Ways to Pay

You have several options to pay for projects:

Cash or check. The easiest option has no applications, forms, appraisals, debt, or interest. Need time to free up money? Ask contractors when payments are due. For remodeling work, it’s common to pay as each stage of the project gets completed. For one-day jobs such as most roofing work or HVAC installs, you usually pay when work is done; also, many contractors will invoice you, giving you 10 to 30 days to gather funds.

Credit cards. Credit cards usually impose higher interest rates than other financing options. On the other hand, if you need a very short-term loan, consider opening an account with a low introductory interest rate. The big benefit of paying via credit card is that you can dispute a transaction and request a chargeback if you’re not satisfied with the work and the contractor won’t make things right.

Home equity loans. These second mortgages offer fixed rates and terms, using your home’s equity as collateral. While they require applications, credit checks, appraisals, and closing costs, they’re easier to arrange than mortgages and typically offer lower interest rates than contractor financing. Most lenders cap loans at 80 percent of your home’s appraised value. Interest is tax-deductible if you itemize deductions.

Home equity lines of credit (HELOCs). These are similar to home equity loans but allow you to borrow funds as needed rather than all at once—ideal for multi-stage remodels. Most carry variable interest rates (usually prime plus a margin) and are capped at 80 percent of home value. Interest is tax-deductible for qualified home improvements.

Cash-out refinancing. This is popular with homeowners who have substantial equity. Lenders pay off your existing mortgage and issue a new, larger loan, giving you the difference in cash. Though they require extensive paperwork, cash-out refis often have low closing costs and allow you to spread the expense of the remodel over the length of your long-term mortgage.

Federal Housing Administration home improvement loans. There are two main types: Title I loans (up to $25,000 at fixed rates, no equity required) and Section 203(k) loans (for buying and rehabilitating properties). Both require working with FHA-approved lenders.