Fraud Alert: Customer Service Imposter Scams

Last updated January 12, 2023

To gain your confidence, con artists lie about who they are. They impersonate IRS agents, debt collectors, bankers, Social Security Administration employees, and law enforcement. These days, they’re also finding it lucrative to pose as customer service agents.

Consumer advocates, including Checkbook, have been warning about these customer service imposters for years, but the scammers continue to cash in.

Listen to audio highlights of the story below:

Customer service scams come in many variations (more on that below), but they all have a few things in common, according to the AARP Fraud Watch Network. Look for these red flags:

- The “representative” doesn’t know anything about your account; they provide only generic details.

- They ask you for personal information that is not needed to handle your problem, such as a credit card or Social Security number to verify a recent purchase or account balance.

- They say you need to pay money to have your problem resolved. Typically, they want to make a withdrawal from your bank account, seek a credit card payment, ask you to buy them a prepaid gift card, send cash via wire transfer, or push you to make a transaction at a cryptocurrency ATM.

- They want remote access to your computer or smartphone in order to help solve your problem. They may even ask you to download software to enable this remote access.

There are three basic ways criminals running customer service scams typically initiate contact: search engine listings, robocalls, and email or text alerts.

Spoofed Phone Numbers for Customer Service

If you have a problem with a product or service, going online to search for a number to call for companies’ customer service departments can be problematic.

Criminals now run their own bogus customer service call centers—often pretending to be big companies—that are designed to steal your money and sensitive personal information.

“The scammers can buy their way onto the search engine results or embed some of these fake customer service numbers in pages like Reddit or any other kind of consumer-focused website,” said Amy Nofziger with the AARP Fraud Watch Network.

Sometimes, the customer service imposter who answers the phone will simply say, “Customer service, how many I help you?” But most of the time, they will answer with the name of the specific company you thought you dialed, Nofziger told Checkbook.

Fraudulent Email and Texts

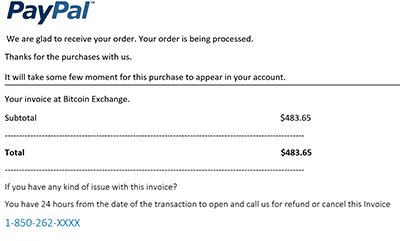

Customer service imposters send out email and text message alerts that are made to look like they’re from a familiar company, such as Amazon, Apple, Best Buy, FedEx, MasterCard, PayPal, UPS, and Visa.

Because of its massive customer base, Amazon is the company most often impersonated by customer service scammers. But these crooks will use any brand name that is instantly recognizable and likely to be trusted.

Fake emails and texts sent by scammers are designed to jolt you into action; to get you to click a link or call the customer service number listed right away, such as:

- Your credit card account has been frozen due to suspicious activity.

- A major purchase was made on your account.

- A package headed your way that cannot be delivered.

Some examples of these messages:

The bogus email above is for a security service contract that you didn’t order. The scammers hope you’ll call the fake customer service number they’ve set up to cancel. When you do, they’ll ask for personal info they can use to steal your identity or payment information they can use to squeeze money from your accounts.

The fake email above looks like it was sent by PayPal, but wasn’t. The scammers who sent it hope you’ll call their phone number to dispute the transaction.

Fraudulent Phone Calls

While a significant amount of fraud has moved online, con artists still find telephones to be valuable tools for scamming people.

While the initial call might be from a real person in a telephone boiler room, most phone fraud starts with robocalls that try to get you to speak to a customer service representative. Here are a few examples provided by Nomorobo, a popular robocall blocking service.

“We have noticed a suspicious order from your Amazon account for an iPhone 12 pro for an amount of $999, scheduled to be delivered to Orlando, Florida. If you haven’t placed this order, then please press one to speak to a representative immediately.”

“Dear Bank of America customer, we found some suspicious activity on your Bank of America account. Your Bank of America debit card has been charged at $1,998 on suspicious merchandise. If you did not authorize this transaction, please press one to connect with Bank of America fraud specialist for dispute.”

“Hearing that a big purchase you didn’t make is being charged to your account is really motivating,” said Aaron Foss, creator of Nomorobo. “When you’re scared, you’re more likely to do something that seems a little bit out of the ordinary, like giving money to a stranger on the phone.”

Listen: Nomorobo has various examples of these bogus customer service robocalls.

If you take the bait, you’ll be connected to a con artist who promises to take care of everything. Before you know it, you will be falling down a rabbit hole that doesn’t end until the fraudsters get your money.

They might ask for a credit card number, wire transfer, or P2P app (such as Zelle, Venmo, or Cash App) payment. They may tell you to go to the store and buy gift cards and then read them the numbers off the back. In some cases, when all else fails, they will urge you to send cash via FedEx or U.S. Mail. (They really do that!)

A New Twist

The AARP Fraud Watch Network warns that criminals have come up with a new and “more sophisticated” version of the customer service imposter scam. It starts with a letter that appears to be from a bank or finance company, alerting you to an issue with your mortgage. The instructions say to scan the QR code printed on the letter to contact customer service.

“That code will take you to a lookalike website, where you will be asked to type in your personal and payment information,” AARP’s Nofziger warns. “That will enable the crooks to take your money.”

How to Protect Yourself

It may be difficult to understand how someone could fall for some of these scams. But professional con artists are well-trained to take advantage of stressed-out consumers seeking help.

“These criminals are really good at their jobs,” Foss said. “They know persuasion techniques. They’ve practiced it. It’s a regular job for them. So, looking back, yeah, obviously it’s scam, but when you’re in the middle of it, you don’t know it.”

Most people lose $500 to $1,500 in these customer service imposter scams, Foss told Checkbook. The greatest losses happen—tens of thousands of dollars—when crooks convince their victims to allow them to install remote access software on their computers.

“They’ll say they just need to check your bank account and make sure there are no other fraudulent transactions,” Foss explained. “Before you know it, you get caught up in this scam, and that crook is using your computer to drain your bank account.

Never allow anyone to have remote access to your device. Once a criminal has control, they can rob you blind. That’s what happened to Ginger, who lives near Nashville, Tenn. Somehow, she dialed the wrong number for Amazon customer service to get a refund for a package that never arrived.

The customer service imposter, who told Ginger he wanted to put $500 in her bank account, convinced her to give him remote access.

“I thought I was talking to Amazon. They sounded like Amazon. I made the call, so I trusted him,” Ginger told Checkbook.

The Amazon imposter then told Ginger he accidentally put $1,500 in her account. He said she would need to return the $1,000 via a Zelle money transfer.

“He gave me a song and dance routine about how he would be in big trouble if she didn’t return the money,” Ginger said. So, she did.

After she got off the phone, Ginger discovered that the criminals had accessed her PayPal account to go on a shopping spree, hundreds of dollars in purchases. Luckily, PayPal gave her the money back, but Ginger realizes the $1,000 she sent the scammers via Zelle is gone forever.

Related: Banks Often Refuse to Help Victims of Zelle Scams

Also be wary of unsolicited phone calls, even from companies with which you have accounts.

“Look, Amazon is not going to call you and tell you that there is an incorrect charge on your account, neither is Apple, Walmart, or Best Buy,” Foss said. “If you get these calls—hang up!”

And never call a customer service number included in a text message or email. You have no way to know if it’s legitimate. Use a number you know is real—look at your account information, invoice, statement, or the back of your credit card.

Here are some more tips from the AARP Fraud Watch Network:

- If you need to reach a company’s customer service department, don’t do an internet search for its phone number; instead, go directly to that company’s website to find it there. And don’t click on phone numbers sent to you in emails or via text.

- To avoid fake links sent by scammers in emails and texts that might send you to fake sites or unleash malware onto your device, leave the message and type the company’s web address into your browser manually.

- Especially avoid using your phone to follow links to e-commerce and payment websites. Instead, consider using a computer so you can hover your mouse pointer over hyperlinks to see where they take you. That might help you to detect if a site is a clever look-alike.

- Hang up on any customer service representative who asks you to download and install any app on your device that allows someone remote access to it. No legitimate representative would ask you do to that.

- If someone who claims to be a customer service rep pressures you to give up sensitive personal or financial information, it’s a sure sign that the person is a fake.

- Keep secret any PINs. A fake customer service rep might ask for it as a source of identification, then use it to drain your bank account. A real customer service representative will never ask for your PIN.

More Info

- If you get a call, text, email, or social media message and don’t know what to do, call the AARP Fraud Watch Network Helpline at 877-908-3360 before you provide an unknown caller with information or money. You do not need to be an AARP member to use this free service.

- The BBB and Amazon have created a consumer education campaign to help you avoid impersonation scams.

- How to avoid trouble and scams when using payment apps.

- How to keep your computers and devices safe.

- How to protect yourself from identity and cyber threat.

Contributing editor Herb Weisbaum (“The ConsumerMan”) is an Emmy award-winning broadcaster and one of America's top consumer experts. He has been protecting consumers for more than 40 years, having covered the consumer beat for CBS News, The Today Show, and NBCNews.com. You can also find him on Facebook, Twitter, and at ConsumerMan.com.