New Report: Credit Unions and Small Banks Often Offer the Best Credit Card Rates

Last updated February 22, 2024

Looking for a credit card? Be sure to check offers from credit unions and small banks. According to a new report from the Consumer Financial Protection Bureau (CFPB), large banks tend to offer “worse credit card terms” and “substantially higher interest rates” than credit unions and small banks.

Listen to audio highlights of the story below:

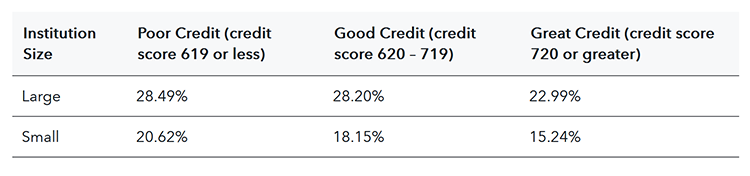

CFPB’s market survey found that on average the nation’s 25 largest credit card issuers charged interest rates eight to 10 points higher than credit unions and small- and medium-sized banks. The Annual Percentage Rate (APR) offered by credit unions and small banks tended to be cheaper for all customers, regardless of credit scores.

The CFPB chart below reports results from the agency’s survey of 643 general-purpose credit cards from 84 banks and 72 credit unions offered during the first half of 2023.

Note: Federal credit unions, which are included in the small-lender category, are legally prohibited from charging interest of more than 18 percent APR.

A cardholder with an average balance of $5,000 would save $400 to $500 a year using a lower-rate credit card from a small bank or credit union, the CFPB analysis showed. Since the average cardholder currently has a balance of $6,300, according to TransUnion, many consumers will see even greater savings.

Fifteen credit card issuers had at least one product with an APR of more than 30 percent. Many of these high-cost products were private label or co-branded cards offered through retail partnerships. Nine of the cards with an APR of more than 30 percent were from these big banks:

- Ally Bank

- Capital One

- Citibank

- Comenity Capital Bank (Bread Financial)

- First National of Omaha

- First Premiere Bank

- Merrick Bank

- Synchrony Financial

- USAA Federal Savings Bank

Julie Margetta Morgan, an assistant director at the CFPB, told Checkbook she found the report to be “really eye opening” about the amount of money people can save if they shop around for their credit cards.

Big Banks Also Charge Higher Annual Fees

If you pay your balance off in full each month, as half of all cardholders do, according to Bankrate.com, then you don’t need to worry so much about interest rates. You should focus on fees.

“Consumers are more likely to be charged an annual fee by a large credit card company than a small one,” Morgan said. “Larger issuers were three times as likely to charge annual fees, and their average fees were higher.”

In fact, the average annual fees at larger institutions were 70 percent higher than at small institutions—$157 versus $94—the CFPB survey found.

“Most people don’t really like annual fees, but for a certain kind of person, especially a frequent traveler, they might be worth it,” said Ted Rossman, senior industry expert at Bankrate.com. “So, I think it’s really important to think through your specific circumstances.”

For those who never carry a balance, the miles, points, or cash back could justify the annual fee. Large banks use rewards as a major part of their marketing campaigns. But the benefits of those programs can be elusive, the CFPB cautions.

The fact is, there are plenty of good cash-back rewards cards that don’t charge an annual fee.

“We found that for most people, a no-annual-fee cash-back card is the best choice, and the most preferred option. Something like a no annual fee, two percent cash back card is surprisingly hard to beat,” Rossman told Checkbook.

The Push for More Competition

The CFPB believes the lack of competition in the credit card industry “likely contributes to higher rates at the largest credit card companies.”

The agency’s research found “high levels of concentration and evidence of practices that imply anti-competitive behavior in the credit card market.” The top 10 lenders “dominate the marketplace,” according to another CFPB report released last October. The top 30 credit card issuers held 95 percent of all credit card debt last year.

“With over $1 trillion in credit card debt outstanding, the CFPB will be accelerating its efforts to ensure that consumers can access better rates that can save families billions of dollars per year,” CFPB Director Rohit Chopra said.

The banking industry disputes the CFPB’s conclusion. The American Bankers Association (ABA) and the Consumer Bankers Association (CBA), describe the credit card market as vibrant and highly competitive.

“This may be the only time that anyone has pointed to a market with vastly different prices as an indication of competition problems,” said Lindsey Johnson, president CEO of the Consumer Bankers Association, in a statement. “Sometimes a consumer just wants a drive-thru hamburger. Sometimes a consumer wants a steak. A thriving marketplace means that consumers can choose products that may have different prices and offer features, perks, or other value that’s specific to them.”

ABA spokesperson Sarah Grano said the CFPB’s data “shows that interest rates are set in a highly competitive credit card market, which offers consumers a wide range of options to find the card that best meets their needs.”

“Americans need only look at their mail and their email inbox to know the many credit card choices they have,” Grano said.

Looking Ahead

The CFPB said it plans to jumpstart competition and lower rates by providing information on credit card pricing every six months. The next report is due this spring.

“It’s important for people to shop around a little bit more to take a look at local banks, maybe their local credit union, to understand what’s available to them,” Morgan said.

The bureau is working on a new consumer-facing tool that will enable consumers “an unbiased way” to compare credit card terms and interest rates. The tool would provide an alternative to comparison websites that the CFPB said “might promote more expensive products over cheaper alternatives.”

More from Checkbook:

- Credit Cards: Picking the Best One for You

- Consumerpedia Podcast: Finding a Credit Card That’s Right for You

Contributing editor Herb Weisbaum (“The ConsumerMan”) is an Emmy award-winning broadcaster and one of America's top consumer experts. He has been protecting consumers for more than 40 years, having covered the consumer beat for CBS News, The Today Show, and NBCNews.com. You can also find him on Facebook, Twitter, and at ConsumerMan.com.