Last updated October 31, 2024

Despite stretched household budgets and concerns about the economy, American shoppers are expected to spend more—and take on more debt—this holiday season. Consumer spending on gifts, food, decorations, and other seasonal items is expected to hit a record of $902 per person, $25 more than last year, according to the National Retail Federation’s annual survey.

Click below to listen to our Consumerpedia podcast episode.

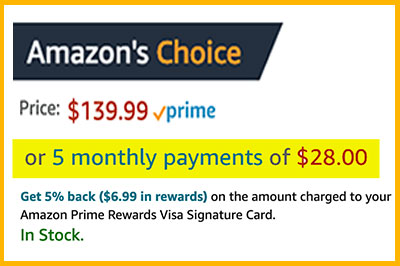

The number of shoppers using buy now, pay later (BNPL) financing continues to grow. Adobe predicts BNPL will hit a record $9.5 billion during the month of November and it forecasts that Cyber Monday 2024 will be BNPL’s largest day ever, at $993 million.

The financial technology companies offering these point-of-sale loans (and they are loans) have a marketing message that appeals to cash-strapped families who don’t have credit or have maxed out their cards. They promote BNPL as “a smarter way” to pay than with credit cards, one that offers “flexibility” and “no surprises.” Approval is instant, and there’s no hard credit check.

When used wisely, these loans can help consumers deal with cash flow problems without turning to more expensive credit, such as payday loans or high-interest credit cards. When they aren’t used wisely, they can turn into high-cost loans with serious consequences.

Borrowers who don’t make payments on time can get hit with costly penalties—and sometimes, a ding on their credit reports.

Listen to audio highlights of the story below:

“Buy now, pay later is only free if you follow all the rules, understand how it works, and make all your payments on time,” said Annie Millerbernd, personal loans authority at NerdWallet.

“People might think…it’ll be fun, and it’ll be free, but that’s not necessarily the case,” said Adam Rust, director of financial services at the Consumer Federation of America. “There are plenty of ways to get in trouble with BNPL.”

Rapid Growth

The typical BNPL loan is six weeks with no interest—although there may be penalty fees for late payments. Purchases are split into four smaller ones: You pay one-quarter at the time of purchase, followed by three equal payments every second week.

BNPL financing has been available in the U.S. for about 10 years, but it went mainstream during the pandemic with the explosion of online shopping.

Now, BNPL is ubiquitous; heavily marketed to younger and less-experienced consumers—as well as to those with little credit or subprime credit scores—who have few options if they want to spread out payments for large purchases.

The number of BNPL loans originated in the U.S. by the five major providers (Affirm, Afterpay, Klarna, PayPal, and Zip) grew by 970 percent (from 16.8 to 180 million) from 2019 to 2021, according to a market analysis by the Consumer Financial Protection Bureau (CFPB). During that same time period, the dollar volume of those loans grew by 1,092 percent, from $2 billion to $24.2 billion.

BNPL companies are expanding into physical stores, and are available on some digital wallets, such as Apple Pay and Google Pay. PayPal has its own BNPL product.

Merchants who accept buy now, pay later typically pay a BNPL lender three to six percent of the purchase price—significantly more than the fee to process credit card payments. Why? Because consumers “often buy more and spend more with BNPL,” the CFPB noted.

Many retailers find that having BNPL financing available at checkout “increases conversion rates by 20-30 percent and lifts average ticket sales by 30-50 percent,” according to a market analysis by RBC Capita. That could explain why a LendingTree Survey of BNPL users in 2022 found that 70 percent said they spent more paying this way than they would have otherwise.

Returns Can Be More Difficult

Paying using a BNPL service can make it more challenging to get help if you cancel a purchase or are not satisfied with the merchandise you received. There’s now another company, the BNPL service, between you and the retailer.

In many cases, customers who request refunds from their BNPL lenders are told to deal with the merchants who sold them the products. But until refunds get approved (and there’s no guarantee they will) customers are required to continue making payments.

This is creating “chaos for some consumers” when they want to return something or encounter other problems, CFPB Director Rohit Chopra noted.

As BNPL loans have soared in popularity, so have complaints about lenders to the CFPB and other consumer agencies. As of October 30, 2024, the Better Business Bureau had closed a combined total of 6,902 complaints in the last three years against Affirm, Afterpay, and Klarna. The three companies had average customer ratings of one out of five.

Buy Now, Pay Later Loans Can Become Debt Traps

The Financial Technology Association (FTA), the trade group for many BNPL companies, says most people have “good experiences” with buy now, pay later loans. “The reality is people are using BNPL responsibly,” said Miranda Margowsky, the FTA’s head of communications. “It’s a service they like to use…and once people use BNPL, they tend to use it again.”

Margowsky told Checkbook that the delinquency rate reported by the association’s members is less than two percent, compared to nine percent for credit cards.

Ed deHaan, a professor at the Stanford Graduate School of Business, called this “a misleading statistic.” The default rates on BNPL loans are low, he said, because BNPL lenders “do a great job of having people prioritize those payments.”

Traditional credit cards rely on profits from debt; these companies want us to spend more than we can pay back each month. But if you miss a BNPL payment, “they will immediately cut off credit,” deHaan explained. “So, if you’re deciding, do I pay down my credit card versus pay down my BNPL, many people chose the BNPL.”

While BNPL lenders warn of the pitfalls of using credit cards, research shows using BNPL can also cause financial distress. deHaan was the lead author of a study, “Buy Now Pay (Pain?) Later,” which analyzed banking data for 10.6 million U.S. consumers. It concluded: “BNPL users experience rapid increases in overdraft charges and credit card interest fees, as compared to non-users.”

Credit counselors now frequently see clients who are paying off multiple loans from different BNPL lenders and falling behind. This “stacking” has become common among people who are struggling financially. The payments for each loan may be small, but they can quickly add up.

Lara Ceccarelli is an NFCC-certified credit counselor at American Financial Solutions, a nonprofit counseling agency based in Seattle. Ceccarelli said AFS is seeing an increasing number of clients struggling to pay multiple BNPL loans.

“There’s no interest on the loans, which is fantastic, but it doesn’t mean that the payments aren’t creating a hardship,” Ceccarelli said. “Consumers are using these products to cover purchases that they don’t have the cash on hand for, and their budgets are already tight, which is why they’re having to turn to these products. And the recurring payments that stack up are making those budgets even tighter. So, it’s this kind of compounding problem.”

Since most BNPL loans (90 percent) are linked to a debit card, there can be overdraft fees if there’s not enough money in the checking account to cover the automatic withdrawal. And defaulting on the loan can damage your credit.

Ceccarelli’s advice: Just because you qualify for a buy now, pay later loan doesn’t mean you should use it.

Delinquency Rates and Late Fees

Most BNPL installment payments (90 percent) are made by automatic withdrawals from debit cards. If there’s not enough money in the account, BNPL lenders typically charge a late fee of $7 or $8 per missed payment. If the electronic debit overdraws a checking account, the financial institution might charge its own overdraft fee.

If several BNPL lenders are making scheduled electronic debits, those multiple withdrawals might get you in trouble very quickly.

A recent survey of BNPL borrowers by LendingTree found that:

- One-third (34 percent) said they’ve paid late in the past year; another 13 percent paid late at some time. That means nearly half of BNPL users (47 percent) have paid late on one of these loans at some point, up from 40 percent in 2023.

- Forty-three percent said they regretted financing a purchase with BNPL, and a third of those with regret leveraged BNPL for a purchase of $500 or more. That makes sense when you consider that 54 percent of BNPL borrowers said they’ve financed a purchase this way knowing they couldn’t afford it at the time.

The Financial Technology Association told Checkbook its members have safeguards in place to make sure customers don’t take on too much debt. Those who miss payments cannot make new purchases.

Except for accounts that go to collection, most BNPL transactions are not reported to credit bureaus, so BNPL lenders have no idea how many other loans their customers have with other lenders or BNPL companies. And unlike credit card issuers, BNPL lenders are not required to determine if potential borrowers have enough resources to repay their debt.

Note: Because most BNPL lenders do not report on-time payments to the credit bureaus, these loans will not help you build a credit history.

Affirm and Klarna, two of the largest BNPL companies, insist they only extend credit to those who can pay. Affirm said it uses continuous learning models to “assess the consumer’s repayment ability before making a real-time underwriting decision.”

Both companies said they provide alternatives to revolving credit card debt. “Our BNPL products are not built on encouraging people to borrow as much as possible at the highest possible rate, like credit card providers,” Affirm’s spokesperson said.

Of course, you don’t pay interest to credit card companies if you pay your bills in full each month. And credit card companies provide monthly statements, with clear due dates and notices of how much more you’ll owe if you don’t pay on time.

It’s All About Data Mining

Most BNPL companies make their money from retailers, who pay commissions from sales or buy targeted ads on their websites or apps. Another important source of revenue is from leveraging customers’ data. Because BNPL firms aren’t considered banks or financial institutions, there are few restrictions on what they can do with the information they collect.

These companies operate more as advertisers and online shopping malls than creditors and use their customers’ browsing and spending habits against them by inundating them with additional offers.

According to the CFPB, BNPL lenders are “harvesting and leveraging our data to grow revenue outside of their core lending business in ways that we do not see with other lending products.”

Credit card companies are also doing more with our data, but BNPL “is at a different level,” the CFPB cautioned. “Using their proprietary interfaces, buy now, pay later firms can use our data to determine what products we see through paid product placement. This opens up the door to digital dark patterns, and even the potential to price products based on our behavior.”

Consumer advocates are also concerned about data collection by BNPL apps. “A lot of consumers just don’t know how much data is collected on them, and how it might be used to make them buy more,” said Nadine Chabrier, senior policy counsel at the Center for Responsible Lending.

BNPL Was Designed to Avoid Consumer Protection Safeguards

“This is shadow banking at its worst,” said Marshall Lux, a senior fellow at Harvard University and co-author of the working paper Grow Now, Regulate Later? Regulation urgently needed to support transparency and sustainable growth for Buy-Now, Pay-Later. ”The fact that it is almost completely unregulated is terrible.”

It seems like financial technology companies created BNPL financing to avoid federal regulation, Lux told Checkbook.

“The fact that the Truth in Lending Act applies to five payments or more, and the most common form of [BNPL] is four payments, says that someone thought carefully about how to construct this thing,” he said. “This is not technically classified as a loan, but for God’s sake, it’s a loan…and consumers need to be protected.”

As Checkbook previously reported, the Consumer Financial Protection Bureau issued a rule earlier this year that said purchases made with BNPL loans should be covered under the Truth in Lending Act. The new rule, which took effect in July, made it clear that BNPL borrowers are entitled to most of the key legal protections and rights that apply when purchases are made using conventional credit cards, including the right to dispute charges, demand refunds, and receive periodic billing statements.

On Oct. 18, the FTA filed a lawsuit asking the U.S. District Court in Washington, D.C. to set aside the “arbitrary and capricious” rule. The CFPB did not consider how the new disclosure obligations “are ill-fitted” for the way BNPL products operate, the lawsuit alleges.

In a statement, FTA president and CEO Penny Lee, said the industry “is committed to working with the CFPB and other regulators to craft durable rules for the future to fit the unique nature of pay-in-four BNPL products.”

FTA told Checkbook it disagrees that BNPL was created to evade U.S. laws, pointing out thus short-term financing originated in Australia and Europe.

How to Use BNPL Wisely

Before you apply for any credit, ask yourself: Is this purchase really necessary? What impact will this new debt have on my overall finances?

If you have the money to pay for the purchase but simply don’t want to use a credit card, or you know you’ll have the money to make the payments as they come due, then it might be a viable option. Even so, experts recommend having only one BNPL at a time.

A recent Harris Poll survey conducted for the National Foundation for Credit Counseling (NFCC) found that 10 percent of BNPL users have low credit scores and can’t qualify for credit any other way. Another 10 percent said they used BNPL because they maxed out their credit cards.

“If you’re in either of those situations, run away from the buy now, pay later offer like it’s on fire,” said NFCC senior vice president Bruce McClary. “These debts can pile up quickly, and you risk jeopardizing your other financial obligations.”

If you find yourself in financial trouble, talk to a non-profit credit counselor who can show you the way forward. Visit the NFCC website, or call 800-388-2227. The first session is typically free.

More Info:

Checkbook’s Consumerpedia podcast, episode 73: Holiday Shopping Tips 2024

U.S. PIRG: Buy Now, Pay Later Plans: Tips to Avoid the Pitfalls

Contributing editor Herb Weisbaum (“The ConsumerMan”) is an Emmy award-winning broadcaster and one of America's top consumer experts. He has been protecting consumers for more than 40 years, having covered the consumer beat for CBS News, The Today Show, and NBCNews.com. You can also find him on Facebook, Twitter, and at ConsumerMan.com.