Last updated July 2025

Click below to listen to our Consumerpedia podcast episode.

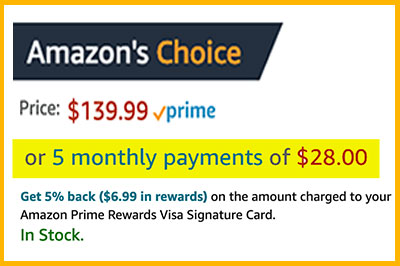

Buy Now, Pay Later (BNPL) financing continues to grow in popularity for both online and in-store purchases. These short-term loans—typically six weeks and usually interest-free—appeal to consumers who want flexible payments and no credit card debt.

A report from CapitalOne Shopping predicts BNPL transactions in the U.S. will total $122 billion this year and hit $184 billion by 2030. An estimated 86.5 million Americans used BNPL last year to purchase a wide range of products, including clothing, appliances, electronics, vacations, groceries, and gasoline.

BNPL purchases are split into four payments. The first installment is made at the time of purchase, followed by three equal payments every other week. The loans are typically linked to borrowers’ bank accounts and payments are withdrawn automatically. If a payment overdraws an account, some banks charge penalties. The average overdraft fee is currently $27, according to Bankrate.com.

Consumer advocates caution that BNPL loans make it too easy for some people to overspend, which can result in costly late fees.

“It can make things look more affordable than they really are,” said Lauren Saunders, associate director of the nonprofit National Consumer Law Center. “Paying $25 [now] seems a lot cheaper than $100, and people aren't necessarily paying attention to how quickly the rest of that $75 is going to come due.”

Adam Rust, director of financial services at the Consumer Federation of America, reminds shoppers that buy now, pay later is only free if they understand how it works, follow all the rules, and make all payments on time.

“There are plenty of ways to get in trouble with BNPL,” he warned.

How BNPL Started

BNPL financing is relatively new. When Affirm launched in the U.S. in 2012 and Klarna in 2015, they provided a way to make big-ticket purchases, such as expensive TVs and exercise equipment, appear more affordable. The pay-later model gained mainstream popularity during the pandemic, driven by the surge in online shopping.

Now, BNPL is ubiquitous, available online, in stores, and on some digital wallets, such as Apple Pay and Google Pay. PayPal has its own BNPL product, Pay in 4.

Merchants that offer BNPL typically pay lenders three to six percent of the purchase price, significantly more than the fee they pay to process credit card payments. Why? Because consumers “often buy more and spend more with BNPL,” according to a report from the Consumer Financial Protection Bureau.

A study reported in the Harvard Business Review found that shoppers who use BNPL were likely to spend 17 to 26 percent more. The researchers were surprised to find that the increases in spending lasted for nearly six months, “showing that BNPL drives lasting gains rather than short-term spikes in consumer spending.”

BNPL Is Targeting Specific Consumers

BNPL is heavily marketed to younger consumers and those with subprime credit scores. A recent survey by the Federal Reserve noted that BNPL is most often used by low- and middle-income adults. Nearly three quarters (72 percent) of those with an income of less than $50,000 reported using BNPL because it was the only way they could afford to make a purchase.

Because these loans are often taken out impulsively during the checkout process, shoppers may not fully understand how they work or the potential costs. This could explain why late payments are becoming more common. The Fed study found that nearly 24 percent of BNPL users made a late payment in 2024, up from 18 percent the year before.

Pros and Cons

Buy now, pay later lenders promote their service as “a smarter way” to pay than with credit cards, one that offers “flexibility” and “no surprises.” Approval is instant, and there’s no hard credit check, something that’s required to process a credit card application.

A spokesperson for Affirm told Checkbook: “Our BNPL products are not built on encouraging people to borrow as much as possible at the highest possible rate, like credit card providers.”

The Financial Technology Association, the trade group representing BNPL lenders, told Checkbook its members have safeguards in place to ensure customers don’t take on too much debt. For example, a BNPL lender will not allow a borrower who pays late to make more purchases.

Affirm and Klarna, two of the largest BNPL companies, insist they only extend credit to those who can pay. Affirm said it uses continuous learning models to “assess the consumer’s repayment ability before making a real-time underwriting decision.”

But with some BNPL lenders, borrowers who make late payments may incur costly penalties and sometimes receive a negative mark on their credit reports.

As Checkbook reported recently, FICO, the company behind the most widely used credit scoring models in the U.S., will soon launch two new scoring models that, for the first time, will incorporate BNPL payment history.

Credit counselors, who help people who have financial problems, tell Checkbook they’re seeing an increasing number of clients struggling to pay multiple BNPL loans.

“Most people who have buy now, pay later accounts don't have just one, they have multiple,” said Lara Ceccarelli, a National Foundation for Credit Counseling-certified counselor at the nonprofit American Financial Solutions. “It can be really easy to lose track of these payments, and have them stack up, and leave you overextended in your budget.”

Ceccarelli said many of her clients use BNPL to buy things they can’t afford. “There's no interest on the loans, which is fantastic, but it doesn't mean that the payments aren't creating a hardship,” she said.

Personal finance experts worry that a growing number of Americans use BNPL to pay for everyday items, such as groceries and gasoline. Paying for DoorDash deliveries of $35 or more with Klarna is gaining popularity.

What if Something Goes Wrong?

If there’s a problem with the purchase—you don’t receive the items you ordered, you get the wrong merchandise, or it arrives damaged or broken—it may be difficult to get help. Do you contact the merchant or the lender? BNPL companies point to their refund policies, which state that their affiliated sellers are responsible for handling any issues. But it doesn’t always work that way. Based on the complaints Checkbook has examined, you may get the runaround. And while your complaint is being resolved (if it gets resolved at all), your payments will continue.

With a credit card, if there’s a problem with the purchase, you can challenge the charge, and it will be removed from your account while the credit card company investigates.

The Better Business Bureau has received thousands of complaints during the last three years about major BNPL lenders. As of July 15, the BBB website reported the following tallies: Affirm, 6,616; Afterpay, 3,412; and Klarna, 2,647. Each company had a rating of 1 out of 5 stars.

A recent Bankrate survey found that almost half (49 percent) of BNPL users reported at least one problem using these services.

The Smart Way to Use BNPL

When used wisely, pay-later loans may help some consumers manage cash flow issues without resorting to more expensive alternatives, such as payday loans or high-interest credit cards.

BNPL is best suited for occasional purchases where you've planned for the payments and know you can afford them but need some extra time. Avoid using these loans for routine expenses like food and gas.

Only have one outstanding BNPL loan at a time. Pay it off before considering taking out another loan. People who have multiple BNPL loans, a practice known as stacking, are more likely to encounter problems.

If you’re using BNPL to deal with serious financial problems, you should contact a non-profit debt counselor and discuss your options. Contact the National Foundation for Credit Counseling to get started.

Checkbook suggests using a credit card when you can pay the balance in full each month; something about half of all cardholders do. Using credit cards responsibly—always paying on time and keeping the balance small (30 percent or less of your credit limit)—is one of the best things you can do to help build a positive credit history.

“Credit cards are the gold standard in terms of buyer protections, everything from disputes to purchase protection, extended warranties, and travel insurance,” said Ted Rossman, senior industry analyst at Bankrate. “There are a lot of nice benefits, if they're used properly. And rewards are great, too.”

If you plan to carry a balance, don’t even consider a rewards card. The interest you pay will cost significantly more than any reward you earn. Look for a traditional credit card with no annual fee and the lowest interest rate.

Bankrate, Cardratings, NerdWallet, and WalletHub have lists of credit cards with low interest rates and no annual fees.

More from Checkbook:

- Credit Cards: How to Choose the Best One

- Dealing with Debt: Real-Life Success Stories

- Credit Cards Have Consumer Protection Superpowers

Contributing editor Herb Weisbaum (“The ConsumerMan”) is an Emmy award-winning broadcaster and one of America's top consumer experts. He has been protecting consumers for more than 40 years, having covered the consumer beat for CBS News, The Today Show, and NBCNews.com. You can also find him on Facebook, Blue Sky, X, Instagram, and at ConsumerMan.com.