IRS Makes Significant Inflation Adjustments for Tax Year 2023

Last updated April 13, 2023

With the 2022 federal tax filing season behind us, it’s time to look at the major changes that will impact next year’s returns, it’s time to look at the major changes that will impact next year’s returns.

Listen to audio highlights of the story below:

“Each year, the IRS adjusts more than 60 provisions in the individual income tax code,” said Erica York, senior economist with the non-profit Tax Foundation. “This year, it probably stands out more to people because inflation has been running so high, the adjustments are more noticeable than normal.”

Here are the key provisions that will affect most taxpayers:

Standard Deduction Goes Up

Rather than itemize, most people take the standard deduction to lower their taxable income. For tax year 2023 (the return you will file in 2024) the standard deductions will increase by almost seven percent for all filers.

Here are the new standard deduction amounts:

- For married couples filing jointly: $27,700, up $1,800 from the prior year.

- For single taxpayers and married individuals filing separately: $13,850, up $900.

- For heads of households: $20,800, up $1,400.

Income Adjustment to Tax Brackets

The IRS did not make any changes to the seven federal tax brackets, but it did adjust the income thresholds for each. This prevents “bracket creep” caused by higher wages that don’t keep up with higher prices, and therefore don’t improve living standards.

For example, a married couple filing jointly can now earn up to $190,750 and remain in the 22 percent tax bracket. For the 2022 tax year, they couldn’t earn more than $178,150 to be in that bracket.

“The IRS increased the amount you can earn and remain in a lower tax bracket,” said Andy Rosen, investing and tax expert at NerdWallet. “Even though a lot of people are expected to see income growth in 2023, the cost of living has gone up because of inflation more than wages, so this is one way the IRS is trying to account for that.”

For tax year 2023, the top marginal tax rate (the most anyone can be taxed) remains at 37 percent for individual single taxpayers with incomes greater than $578,125 and $693,750 for married couples filing jointly.

The 2023 tax brackets are:

- 35 percent for incomes over $231,250 ($462,500 for married couples filing jointly)

- 32 percent for incomes over $182,100 ($364,200 for married couples filing jointly)

- 24 percent for incomes over $95,375 ($190,750 for married couples filing jointly)

- 22 percent for incomes over $44,725 ($89,450 for married couples filing jointly)

- 12 percent for incomes over $11,000 ($22,000 for married couples filing jointly).

- 10 percent for single individuals with incomes of $11,000 or less ($22,000 for married couples filing jointly).

More Info: 2022-2023 Tax Brackets and Federal Income Tax Rates

Capital Gains Tax

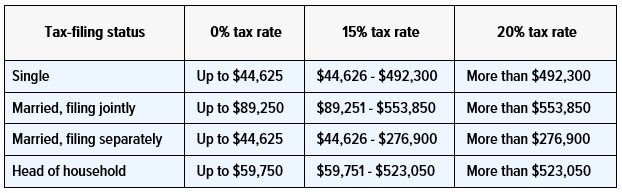

When you sell an investment, such as stocks or cryptocurrency, for more than you paid for it, you owe taxes on the profit. Short-term capital gains are taxed as ordinary income. Long-term gains (generally applied to the sale of assets held for more than one year) are either tax-free, or taxed at 15 percent or 20 percent, based on the taxpayer’s filing status and taxable income.

For 2023, the income thresholds for long-term capital gains were increased by about seven percent, which should also deal with bracket creep. For example, last year, a married couple filing jointly could earn up to $83,350 and not pay any tax on capital gains. For tax year 2023, that income threshold jumps to $89,250.

Here are the long-term capital gains tax rates for 2023 from the IRS website:

More Info: Capital Gains Tax: 2022-2023 Rates and Calculator

Earned Income Tax Credit

The Earned Income Tax Credit (EITC) helps many low- to moderate-income workers and families reduce the taxes they owe and, in some cases, increase their refunds. A number of factors, such as income and children, are used to determine the credit—but people without children can still qualify.

“The Earned Income Tax Credit will also have an inflation adjustment for this year, so you can make a little more than you did in 2022, and still get a pretty good chunk of change back,” NerdWallet’s Rosen told Checkbook.

The maximum credit allowed for qualifying families with three or more qualifying children will increase from $6,935 in tax year 2022 to $7,430 this year.

Other Changes of Note

Here are some other key changes that could impact your 2023 federal tax return:

- The Alternative Minimum Tax exemption was increased to $81,300; that’s $5,400 more than in 2022. It begins to phase out at $578,150, up from $539,900. The exemption for married couples filing jointly is $126,500; up $8,400 from last year. It begins to phase out at $1,156,300, up from $1,079,800 in 2022.

- The maximum contribution employees can make to their health flexible spending account (FSA) goes up to $3,050. For plans that allow unused amounts to carry over to the next year, the maximum carryover amount is $610, an increase of $40 from 2022.

- The foreign earned income exclusion is $120,000, up from $112,000 for tax year 2022.

- The annual exclusion for gifts increases to $17,000, up from $16,000 last year.

- The maximum credit allowed for adoptions is the amount of qualified adoption expenses up to $15,950, an increase of $1,060.

More Info: The IRS has a list of inflation adjustments for tax year 2023 on its website

Contributing editor Herb Weisbaum (“The ConsumerMan”) is an Emmy award-winning broadcaster and one of America's top consumer experts. He has been protecting consumers for more than 40 years, having covered the consumer beat for CBS News, The Today Show, and NBCNews.com. You can also find him on Facebook, Twitter, and at ConsumerMan.com.