Surprise! Your Credit Score Is a Huge Factor in Determining What You Pay for Insurance

Last updated May 2023

In the District and Virginia, insurers use credit scores to help determine premiums for auto and home policies. (Maryland law prohibits homeowners insurance writers from using credit information in setting rates, but auto insurance companies can and do use credit scores.) Some companies also offer lower rates to college graduates and people working in certain fields. Insurance companies increasingly are charging customers very different rates depending on secret formulas based on data unrelated to their customers’ actual claims histories or risk of damage.

In the District and Virginia, insurers use credit scores to help determine premiums for auto and home policies. (Maryland law prohibits homeowners insurance writers from using credit information in setting rates, but auto insurance companies can and do use credit scores.) Some companies also offer lower rates to college graduates and people working in certain fields. Insurance companies increasingly are charging customers very different rates depending on secret formulas based on data unrelated to their customers’ actual claims histories or risk of damage.

Using these complicated formulas, insurance companies calculate insurance scores that are used to determine their rates, or even whether to cover prospective clients at all. The insurance formulas are not the same as those used by lenders (banks, mortgage companies) to calculate credit scores, but they draw on the same types of data. The formulas vary from company to company, since different insurers (or scoring companies) weigh factors differently.

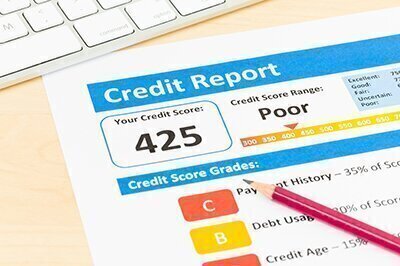

With many companies, your credit score influences the rates you’re offered more than any other factor: Checkbook and other advocacy groups that have studied this issue have found the prices most companies offer customers with poor credit are double what they offer customers with excellent credit; with some companies, the poor-credit penalty more than triples their rates.

Our view is that all states should ban the use of credit scores and other financial information to set insurance rates, for several reasons:

- There’s an alarming lack of transparency. When insurance companies don’t have to disclose the formulas they use to set their rates—even though these formulas have a huge impact on the rates they charge—they circumvent the laws put in place by states to oversee an industry with a long history of racial discrimination and other abuses.

- By relying on credit reports and scores, the insurance companies are using data known to possess many errors.

- The system effectively discriminates against minority groups, who are more likely to have lower credit scores.

- Because insurance has become so expensive for those with low credit scores, many underinsure their cars and homes, or can’t afford to buy coverage at all, leaving them at even greater financial risk.

- Mortgage lenders require borrowers to maintain homeowners insurance policies. The poor shouldn’t have to pay disproportionately large penalties to buy required coverage.

- Another moral issue: Medical debt is a leading cause of low credit scores in the U.S. Should the sick (and their survivors) have to pay double or triple for home insurance?