Here’s where we feature news-you-can-use and other timely information to help you become a more informed consumer. Check back often to read what’s happening.

Government Lawsuit Alleges Three Major U.S. Banks Allowed ‘Fraud to Fester’ on Zelle

The Consumer Financial Protection Bureau (CFPB) has accused Zelle and three of the major U.S. banks that own the most widely available peer-to-peer payment system in America, of “failing to protect consumers from widespread fraud.”...

Watch Out: Fake Reviews Are Everywhere

While the research team at Checkbook.org spends enormous time and resources hunting down and eliminating ratings submitted by businesses, elsewhere, unfortunately, you can’t always trust online reviews.

Buying Toys on Overseas Websites Can be Risky

Cost-conscious consumers have discovered the convenience, low prices, and enormous selection offered by overseas-based websites (such as Temu, Shein, and Ali Express). While the price is right, consumer advocates warn that the safety of these products is not guaranteed.

Watch Out for Worthless Gift Cards

Thieves are increasingly hacking into gift card accounts and draining away their value. Take these steps to avoid buying worthless gift cards.

New Rule Requires Airlines to Provide Automatic Refunds for Canceled or Delayed Flights

To simplify and speed up the process of getting refunds when flights are canceled, the U.S. Department of Transportation (DOT) has issued a new rule that requires airlines to promptly provide passengers with refunds when owed.

Why It’s Time to Ditch Passwords and Switch to Passkeys

The best passwords, even “long and strong” ones, are no match for today’s international crime rings. Many companies have begun to replace passwords with passkeys, which provide better security. Here’s how they work and what to expect.

How New Rules Could Change Real Estate Agent Commissions

As part of a settlement agreement for a class action antitrust lawsuit, the National Association of Realtors (NAR) has, for the first time in decades, changed the way home buyers and sellers interact with their real estate agents. Over time, the new procedures might help home sellers and buyers save money by lowering the commissions they pay agents.

New FTC Rule Will Make it Easier to Cancel Subscriptions

A new FTC rule will soon require companies to provide a “click to cancel” option. The goal is to eliminate the frequent hassles involved with ending unwanted subscription payments.

How to Wipe Your Data Before You Sell, Donate, or Recycle Unwanted Computers and Smartphones

Simply deleting unwanted files, and emptying the recycle bin, does not permanently destroy that data. Here’s how to do that.

CarShield Will Pay $10 Million to Settle Deceptive Advertising Charges

Vehicle-service-contract company CarShield will change its business practices and pay a $10 million monetary judgment to resolve deceptive advertising charges brought by the Federal Trade Commission against its parent company.

Saving on Gas: Which Rewards Credit Cards Offer the Best Deals at the Pump?

Don’t assume that gas station credit cards offer the best discounts or rebates on fill-ups. General-purpose cash-back cards are typically more rewarding.

Credit Card Reward Programs Under Scrutiny by Federal Regulators

The lure of rewards programs encourage people to apply for credit cards and use them to earn free airline tickets or hotel nights. Federal regulators warn that new rules might be needed to protect consumers from unfair industry practices.

FTC Orders Online Used Car Dealer Vroom to Refund Customers $1 Million

Vroom, a Texas-based company that until January sold used cars online, has agreed to settle a lawsuit by agreeing to refund $1 million to customers harmed by its allegedly illegal conduct. Vroom's marketing promised a better way to buy and sell used cars, online, with no need to do go a dealership. Vroom also agreed to change its business practices, should it sell cars online in the future.

Straight Talk About Nutritional Supplements

Most supplements are manufactured and sold with no oversight to ensure quality, safety, and effectiveness. Consumer advocates caution that many of these products are marketed with dubious claims.

UPDATE: CFPB Rule to Ban Medical Debt from Credit Reports Put on Hold

The Consumer Financial Protection Bureau wanted to reduce the financial fallout from unpaid medical debt, a growing problem in the U.S. On Feb. 6, a U.S. District Court judge in Texas delayed for 90 days (until June 1, 2025) the effective date for the Consumer Financial Protection Bureau's final rule that prohibits including medical debt in consumer credit reports.

CFPB Tightens Rules for Buy Now, Pay Later Plans

Beginning later this year, consumers who use Buy Now, Pay Later services should have an easier time disputing charges or getting refunds when they have problems with their purchases.

How to Find a Reliable and Affordable New Car

The U.S. car market has nearly recovered from the pandemic’s impact. There is now an ample supply of new and used vehicles, which has flattened price hikes and increased the availability of incentives.

Summer Surprise: U.S. Travel Costs Mostly Holding Steady

It’s not summer yet, but vacation season is already in full swing for both domestic and overseas trips. What can you expect to pay for your summer getaway? It depends on where you’re headed. Prices are so far holding steady for many destinations but are on the rise for popular vacation spots.

Stay Alert for Medical Billing Fraud

Medical data breaches are becoming increasingly prevalent, posing significant threats to patient privacy.

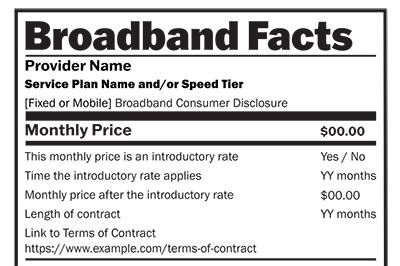

Per New FCC Rule, Internet Service Providers Must Display Broadband ‘Nutrition Labels’ for Clearer Pricing

A new FCC rule requires internet service providers to use standardized “Broadband Facts” labels that display complete and accurate information on costs and typical speeds.