Here’s where we feature news-you-can-use and other timely information to help you become a more informed consumer. Check back often to read what’s happening.

EV Update: More Choices, Better Batteries, but Still Pricey

The U.S. finally has a robust market for electric vehicles (EVs), with more manufacturers offering models that are stylish, roomy, and fun to drive. Unfortunately, high sticker prices remain a deal-breaker for many drivers who want to make the switch.

Not So Fast: Xfinity’s ‘10G’ Internet Service Branding Is Marketing Mumbo Jumbo

Internet customers want fast and reliable broadband service. Comcast promises its “next generation” Xfinity internet service, now branded as a “10G Network,” will deliver both. But “10G” is a meaningless, and possibly misleading, marketing term.

Biden Administration Announces New Rules that Will Eliminate Most Junk Fees

In his February State of the Union address, President Biden promised to crack down on costly junk fees. On Wednesday, two federal regulatory agencies took steps to do that.

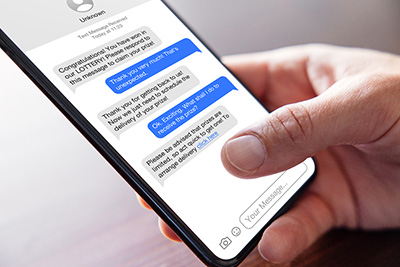

How Criminals Are Using A.I. to Fine-Tune and Scale Up Their Attacks

Fraudsters are already using AI to scam people by using tools to create better emails and text messages, and write malicious code.

Why Am I Getting Email Messages in My Text Folder?

Cybercriminals are now using email to send texts to circumvent spam filters. They’re also hoping this different format will make their spam stand out from the flood of bogus messages.

New Law Targets Online Sale of Stolen and Counterfeit Merchandise

The bipartisan INFORM Consumers Act (Integrity, Notification, and Fairness in Online Retail Marketplaces), which took effect in June, should make it harder for crooks to sell stolen or counterfeit items—and make it more difficult for online marketplaces to ignore the growing problem.

Amazon Raises Minimum Purchase Requirement for Free Shipping in Some Zip Codes

How much do you need to order from Amazon, if you’re not a Prime member, to get free shipping? It now depends on where you live.

Boycott Your Federal Student Loan Payments? Experts Say That’s a Bad Idea

The resumption of federal student loan payments, which begins in October, will be a financial stretch for many borrowers. Some are looking for a way to push back.

Ready or Not, Federal Student Loan Payment Pause Ends August 31

After more than three years, the pause on federal student loan payments will end on August 31. The Covid-related relief program had suspended payments, froze interest, and prohibited collections for about 43 million Americans.

Fraud Alert: Fake ChatGPT Apps Commonplace in App Stores

App stores are flooded with bogus versions of ChatGPT, the popular new artificial intelligence tool.

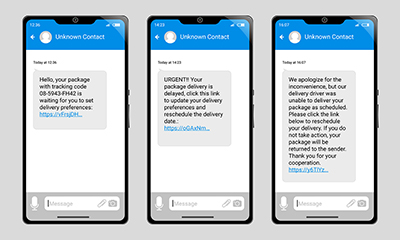

New FCC Rule Requires Phone Companies to Block Some Robotexts

After years of focusing on illegal robocalls, the Federal Communications Commission (FCC) is trying to stop the flood of spam robotexts.

Fraud Alert: IRS Refund Letter is Bogus

While the IRS does contact taxpayers by mail, it never sends letters about refunds. Keeping an eye out for these red flags will help you protect yourself.

Travel Trouble: Don’t Let Passport Problems Wreck Your Trip

If you’re planning a trip outside the U.S. this summer and don’t already have a valid passport—or have one that will expire soon—you may have a problem. The current passport processing time is 10 to 13 weeks.

Consumer Advocates Urge Supermarkets to Stop Digital Discount Discrimination

A coalition of national consumer groups recently sent a letter to the presidents of a dozen large supermarket chains, calling on them to “stop discriminating against senior citizens and low-income shoppers” who cannot take advantage of in-store digital-only discounts.

Stay Safe in the Sun: Top-Rated Sunscreens, and How to Use Them Properly

The Skin Cancer Foundation says a good sunscreen, used properly, can dramatically reduce your skin cancer risk, and lower your chances of getting melanoma by 50 percent.

Why Car Prices—Both New and Used—Keep Going Up

With inventory abnormally low, prices historically high, and interest rates continuing to go up, it’s become harder for many Americans to afford a new set of wheels.

Report: Data Breach Notices Lack Key Details, Enable Identity Theft ‘Scamdemic’

There’s a good chance you received a data breach notice last year—possibly more than one. Unfortunately, last year only 34 percent of breach notices included details about what was obtained from attacks, the lowest number in five years.

DOT Fines 6 Airlines and Orders Them to Refund $600 Million to Stranded Passengers

The U.S. Department of Transportation (DOT) has ordered six airlines to pay $600 million in refunds to passengers who had their flights canceled or significantly delayed during the pandemic. Only one of the six, Frontier, is a U.S. airline.

FTC Proposes New Advertising Guidelines Against Misleading Endorsements

To avoid misleading consumers, endorsements should be genuine and honest, and any relationships (such as compensation) between the advertiser and the endorser should be disclosed. In May, the FTC proposed several revisions to its guides that would clarify and strengthen rules for traditional media, plus apply guidelines to cover influencer endorsements.

Publishers Clearinghouse Settles FTC Lawsuit About Its Popular Sweepstakes

Publishers Clearing House will change its online business practices and refund $18.5 million dollars to customers who “spent money and wasted their time” entering the company’s sweepstakes.